Canada HRSDC SDE 0089-0090 2012-2026 free printable template

Show details

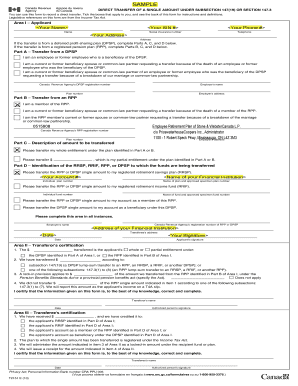

This form is used for transferring Registered Education Savings Plans (RESP) and includes sections for receiving promoter information, receiving RESP information, beneficiary information, transfer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign resp transfer form 2025

Edit your resp forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your resp transfer form part a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

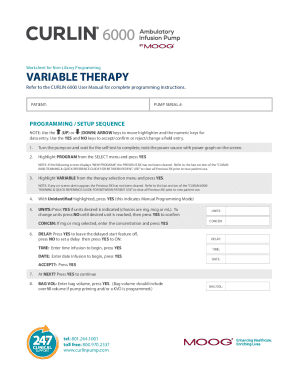

Editing resp transfer form c online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit resp form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out resp transfer form a

How to fill out Canada HRSDC SDE

01

Obtain the Canada HRSDC SDE form online or from the appropriate government office.

02

Read through the instructions carefully to understand the requirements and documents needed.

03

Fill out your personal information accurately in the designated fields.

04

Provide details about your employment history and education, ensuring all dates and titles are correct.

05

Include any relevant supporting documents requested, such as proof of employment or qualifications.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form by the specified method, whether online or by mail, ensuring it is sent to the correct address.

09

Follow up if necessary to confirm receipt and processing of your application.

Who needs Canada HRSDC SDE?

01

Individuals seeking to work in Canada who require a validation of their educational credentials.

02

Employers who need to demonstrate their compliance with labor market regulations in Canada.

03

Foreign workers applying for job positions in Canada that require a Labour Market Impact Assessment (LMIA).

04

Permanent residents or citizens applying for jobs that require specific regulatory approvals.

Fill

registered education savings plan transfer form

: Try Risk Free

People Also Ask about registered education savings plan resp transfer form

How do RESPS work in Alberta?

Under the contract, the subscriber names one or more beneficiaries (the future student(s)) and agrees to make contributions for them, and the promoter agrees to pay educational assistance payments (EAPs) to the beneficiaries. Family plans are the only RESP that allow subscribers to name more than one beneficiary.

Who is the best RESP provider in Canada?

Best RESP Providers in Canada Wealthsimple RESP. Wealthsimple is Canada's top robo-advisor, with over $15 billion in assets under management. Questwealth RESP. Questrade's managed investment services, Queswealth Portfolios, offers RESP plans. Justwealth RESP.

What are the rules for RESP in Canada?

An RESP can remain open for a maximum of 35 years, with a lifetime contribution limit of $50,000 per beneficiary. When your beneficiary enrolls at an eligible post-secondary institution and you are ready to withdraw the funds for educational purposes, the payments can be made from these funds.

What happens to RESP if you leave Canada?

If the beneficiary of an RESP account becomes a non-resident, the account can be kept intact, but no contributions can be made and grants are not paid. If the beneficiary moves back to Canada and re-establishes Canadian residency, contributions can again be made and grants will be paid on contributions.

What is an RESP in the USA?

A RESP account allows money deposited for a child's post-secondary education to grow on a tax-deferred basis. Unfortunately, unlike RRSPs, the RESP is not a tax-deferred plan for U.S. tax purposes. They don't have the same tax-deferral election under the US-Canada Treaty as an RRSP.

Does Alberta have RESP?

There are two types of RESPs: Family Plans can have one or more beneficiaries. Each beneficiary must be under 21, and a child or grandchild of the subscriber, or the person who opens the account. Individual Plans have only one beneficiary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete resp transfer form b 2025 online?

Completing and signing resp tax form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out resp transfer form a 2025 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign resp application form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit resp transfer form part b on an iOS device?

You certainly can. You can quickly edit, distribute, and sign hrsdc on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada HRSDC SDE?

The Canada HRSDC SDE stands for Human Resources and Skills Development Canada Skill Development Employment report. It is a document used by employers to report on certain employment-related data.

Who is required to file Canada HRSDC SDE?

Employers who receive funding or support from the government for employment programs and initiatives are required to file the Canada HRSDC SDE.

How to fill out Canada HRSDC SDE?

To fill out the Canada HRSDC SDE, employers must gather relevant employment data and follow the specific guidelines and format provided by the HRSDC. It usually requires details on wages, hours worked, and employee demographics.

What is the purpose of Canada HRSDC SDE?

The purpose of the Canada HRSDC SDE is to monitor and evaluate the impact of employment programs, ensuring compliance with funding conditions and assessing the effectiveness of skills development initiatives.

What information must be reported on Canada HRSDC SDE?

The information that must be reported on the Canada HRSDC SDE includes wages paid, hours worked, employee positions, demographic information, and outcomes related to the employment initiatives.

Fill out your Canada HRSDC SDE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hrsdc Resp is not the form you're looking for?Search for another form here.

Keywords relevant to resp form b

Related to resp transfer form 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.